Importance of Optimal Leverage in Your Business

The capital structure contains the common stocks of the company with retained earnings. The debt capital along with the equity capital creates the capital of the company for long term. This can also be the permanent capital. Every company relies on the debt and equity of its operation. It expresses how much working capital comes in debts. In addition, it also examines whether the company can easily meet its operational needs or not.

Leverage For evaluating the solvency

The most common and well known financial ratio is the ratio which calculates both the debt and equity. This is known as debt to equity ratio. In order to calculate this ratio, you must know the total debt and equity. To find this number, divide the total debt with the total equity. By doing so, you can easily get the debt to equity ratio. This ratio is vastly used to evaluate the solvency. The financing methods can be easily determine by the leverage ratios.

Impact of leverage on the business

The best way to determine the impact of leverage on the financial performance of the business is by giving a simple example. This factor is called return on equity and it is used to calculate the profitability of the business. Then, by comparing the profit generated in fiscal year which is the time period that a company uses for preparing the financial statements. Along with the shareholders’ invested money.

Return On Equity (ROE)

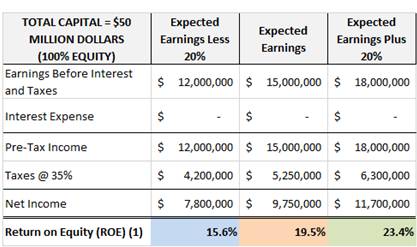

The ROE will be the most common factor to determine the financial status of the business. As the main objective of every business is the growth of their shareholders’ wealth, the rate in equity is the list of return on the investment of its shareholders. Below is the metric that has an income statement of ABC Company, by assuming that the capital structure would be 100%. That is the equity capital. In the past, the raised capital was 50 million dollars. The total value of equity is 50 million dollar because only equity is use to increase the amount. The ROE will fall under such types of structures. It is projected to down its amount to 15.6% and 23.5% as shown. This will depend on the level of the pre-tax earnings of the company.

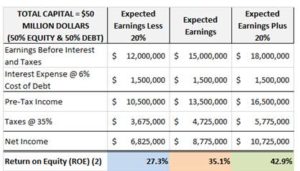

As compare to the above case, when the capital structure of the ABC Company is re-engineered to attain the 50% equity and 50% debt then the return on equity increases to 27.3% and 42.9%.

As the table above shows, the financial leverage can be used to analyze and make the performance of the company much better. That is by solely depending on the equity capital financing.

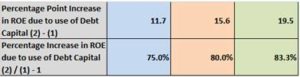

The table below shows the percentage point in ROE and the percentage increase in ROE due to the debt capital.

Are you a small business owner? Or starting up a new business? If you require the funds to start up or tide you over a slight problem, always approach the bank for a loan. If you need it urgently and unable to wait for the bank to process your application, your next best option is a licensed moneylender review.

Have a look through our list of moneylender. All moneylenders listed on Credit Review are license by Ministry of Law.

Do note that as this is a relatively new site, we are still updating our list. If you are a licensed money lender and do not see your company listed here, drop us a message and we will add you in as soon as possible!